LV= (Allianz Group)

Redesigning Car Insurance

Modernised the car insurance process to be more user-friendly and adaptable to changing habits due to COVID-19 while introducing a flexible, monthly car insurance product that can be managed completely online.

Core Services

- Discovery & Strategy

- Consulting

- Mobile Application

- Development

- AI & Machine Learning

- Team Augmentation

Background

In response to evolving consumer behaviours and the increased demand for adaptable insurance products, LV= General Insurance, now part of the Allianz Group, launched a new service called LV Flow. Aimed at a younger, digitally savvy generation, this service was designed to simplify car insurance management and make it commitment-free. As part of Allianz’s broader digital strategy, LV Flow has transitioned into Allianz Car Insurance.

Why Bit Zesty?

Bit Zesty was selected for our expertise in User Experience (UX), User Research (UR), and User Interface (UI) design. Tasked with creating intuitive user journeys and designing a user interface for this innovative insurance service, our comprehensive experience in crafting user-centric digital solutions made us the ideal partner to spearhead this digital transformation project.

The Work

User Experience and Interface Design

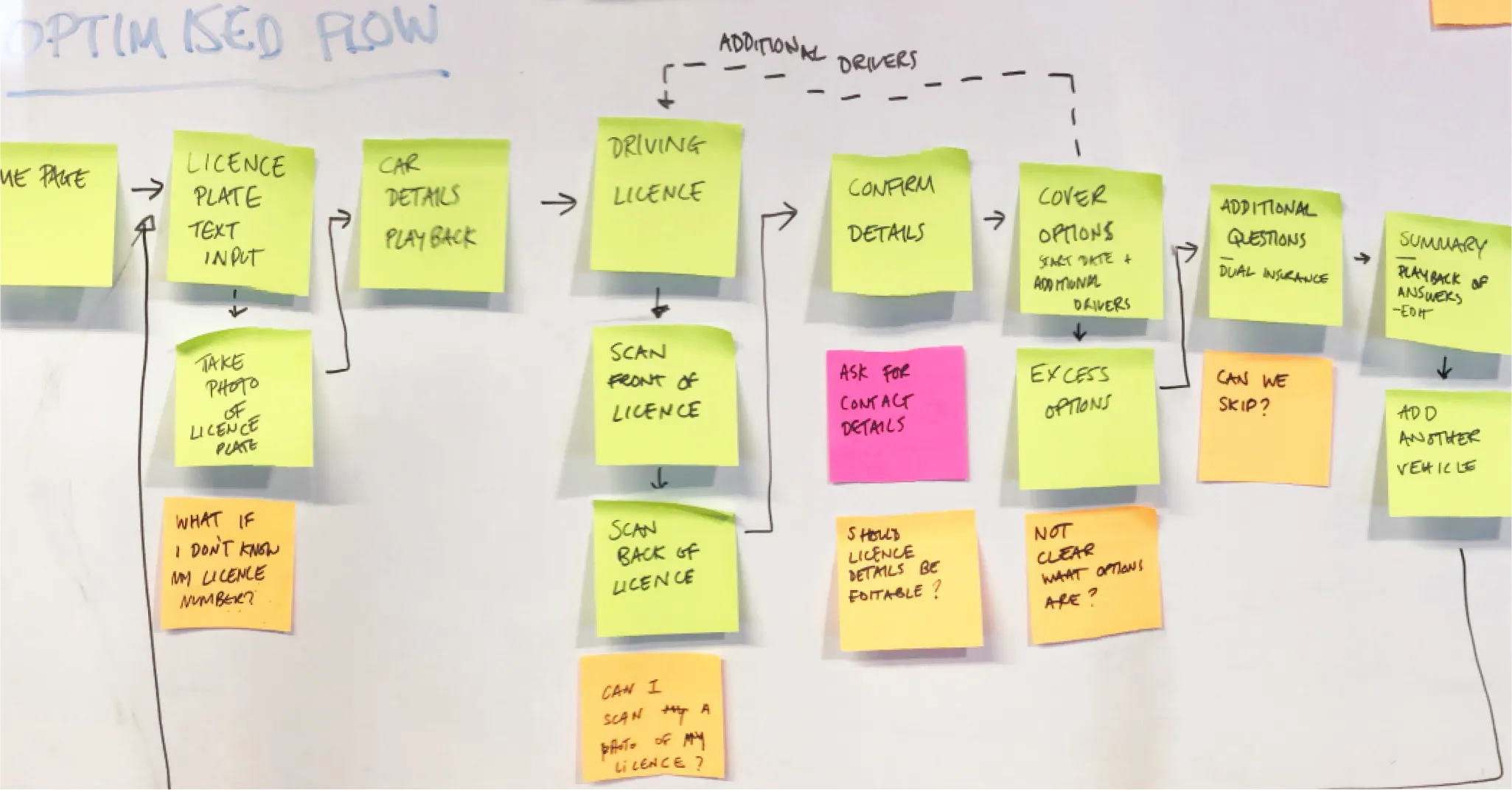

Iterative Design Process:

We adopted a rigorous, iterative design approach involving multiple rounds of wireframes and mockups. These were continually refined based on extensive user feedback to ensure that the final product was visually appealing, highly functional, and user-friendly.

Collaborative Development:

Working closely with LV=’s design and development team, we ensured that the service was on-brand and would be technically possible to implement. This collaboration was pivotal in effectively designing how complex features such as OCR and other APIs would integrate into the service.

User Research and Testing:

A significant part of our process involved conducting detailed user research and multiple rounds of user testing. This allowed us to gather critical insights into user behaviours and preferences, which informed the ongoing refinement of the platform’s UX and UI.

Technical Integration and User Journey Optimization

Sophisticated Technology Utilisation: The service employed Optical Character Recognition (OCR) to facilitate the entry of vehicle and driver information and integrated several APIs to enrich and verify the data collected. This streamlined the application process, making it faster and reducing potential entry errors.

Streamlined User Interactions:

Every step, from gathering initial car details to finalising insurance coverage options, was designed to maximise efficiency and user satisfaction. The design allowed for easy editing and information confirmation, enhancing user trust and compliance.

The Impact

Profound User Engagement

The redesign profoundly improved user engagement, as evidenced by positive feedback highlighting the platform’s ease of use and the effectiveness of the digital tools. Users appreciated the ability to manage their policies flexibly and transparently, reflecting the success of the UX and UI enhancements.

Enhanced Operational Efficiency

The collaboration between the design and development teams led to a seamless user experience that significantly reduced the need for manual data processing and customer service intervention, thereby increasing operational efficiency.